Starbucks has more money than some banks have in deposits

It seems absurd that someone would store money on a loyalty card right? Well it turns out that this absurdity is actually become a reality.

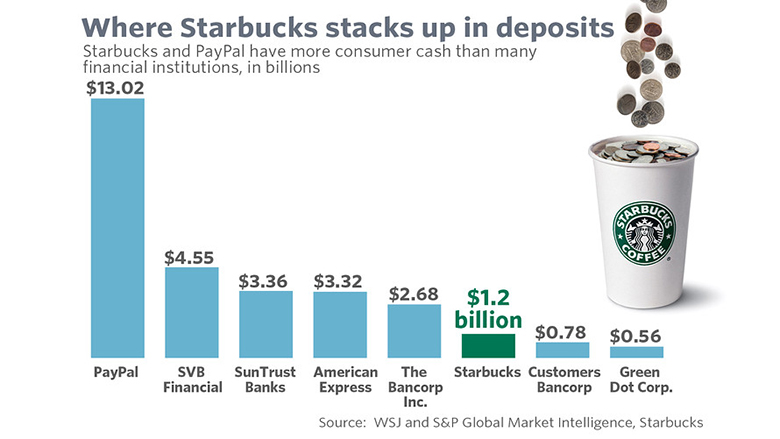

A recent study by the Wall Street Journal – who reviewed data from S&P Global Market Intelligence – found that Starbucks had around $1.2 billion loaded onto loyalty cards.

This raises the question, is Starbucks a bank?

Whilst not traditionally a bank card, a loyalty card can be loaded with money to then purchase food, drink and other merchandise; the coffee shop chain actually has more money ‘deposited’ onto loyalty cards than some American banks.

Exceeding deposits of US financial institutions including California Republic Bancorp, Mercantile Bank and Discover Financial Services.

But what about the figures?

According to this report, during the second quarter of 2016 approximately 41% of all North American Starbucks transactions were made using a company loyalty card.

This equates to roughly 12 million active loyalty scheme members during this period in the US alone.

Although this is in some respects nothing new, the figures are extraordinary given that millions of these pre-loaded cards are purchased on Christmas Eve.

To put these figures into context, Paypal (the global internet payment system), has worldwide customer account balances of $13.02 billion as of the first quarter of 2016. This makes Starbucks $1.2 billion all the more impressive.

But all this begs the question, how much interest are Starbucks making off all this unused money?

Well the American company have increasing market share and have seen an increase of 7.4% on share price within the last year alone.

Could be a solid share to invest in, if this trend continues!

But we must warn that the introduction of mobile payments could change this ‘loyalty card’ landscape, seeing customers move from pre-loading a card or using a pre-paid card to simply paying for products using their mobile device.

Still, we suppose it’s better than trusting some banks!